Expert UK Tax Advice For

Expats & Digital Nomads

Global Tax Consulting is a specialist UK tax advisory firm focused on helping expats, digital nomads, and internationally mobile individuals optimise and manage their UK tax obligations with HMRC.

INTERNATIONAL TAX ADVISORY

At Global Tax Consulting, we provide expert UK tax advice for expats, digital nomads, remote workers, and internationally mobile individuals. Our specialist services cover the full spectrum of cross-border UK tax needs:

We analyse your situation under the Statutory Residence Test (SRT) and help you qualify for split-year treatment or non-resident status, depending on your travel patterns and lifestyle.

Whether you're claiming the FIG scheme, or planning long-term as a non-resident individual, we help reduce tax exposure while staying within HMRC guidelines.

We prepare and submit UK tax returns for both residents and non-residents — including foreign income, split-year claims, FIG filings, and property income disclosures.

We advise businesses on their obligations when employees work remotely from abroad, including PAYE, NIC, and UK employer reporting requirements.

We calculate and report Capital Gains Tax on UK property disposals, file CGT tax returns within the 60 day window and help structure future sales to mitigate tax.

We prepare and submit voluntary disclosures using WDF or Let Property Campaign for undeclared foreign income and undeclared rental income.

EXPATS & DIGITAL NOMADS

Whether you're arriving in the UK, planning to leave, or living a location-independent lifestyle, our expertly written free tax guides provide essential insights into your UK tax obligations and opportunities. Designed for expats, digital nomads, and globally mobile professionals, these resources are practical, up-to-date, and easy to understand.

TOP-RATED UK EXPAT FIRM

We are a team of experienced and qualified tax advisors committed to helping individuals navigate the complexities of the UK tax system.

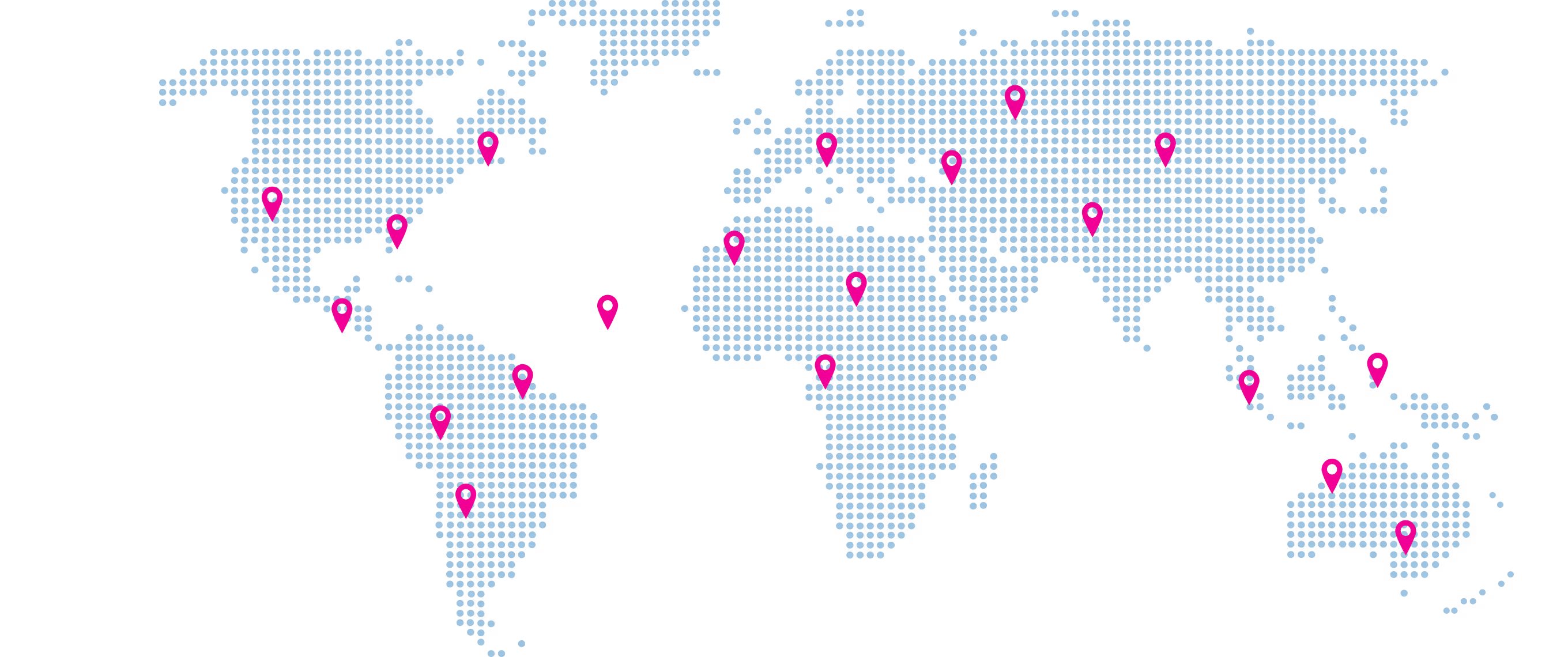

We specialise in cross-border UK tax advice, serving expats, nomads, and mobile professionals in 50+ countries.

100+ 5* reviews across Google and Trust Pilot. GTC is trusted by individuals worldwide to deliver reliable UK tax support.

We fix fees before commencing work — you’ll always know what you’re paying for and payment is due upon delivery of services.

Our online portal makes managing your UK tax affairs easy— securely upload documents, sign forms and message your tax advisor.

Personal Tax Data for 150+ Countries

GTC have launched TaxPilot - a database that gives you instant access to up-to-date personal tax information for over 150 countries. Whether you're relocating, working remotely, or managing multi-jurisdictional income, our tax index helps you compare and understand:

🌍 Start exploring TaxPilots tax data now or speak to an advisor for country-specific guidance.

GLOBAL TAX CLARITY

Digital Nomad Tax Guide: Working for a UK Company Abroad

Working remotely for a UK company? Learn the "feet on the ground" rule, how to stop paying UK tax via PAYE, and how to claim a tax refund from HMRC.

HMRC Rules for UK Income While Living Abroad

Left the UK but still earning from a UK employer, pension, or business? Discover how HMRC taxes non-residents and how to use tax treaties to your advantage.

FIG Regime 101: Guide to UK Foreign Income Relief

Moving to the UK? Learn about the new FIG (Foreign Income and Gains) regime. Our beginner's guide explains how to get a 4-year tax holiday on foreign income.

Selling Your UK Home as an Expat?

Selling your UK home while living abroad? Learn how Capital Gains Tax (CGT) works for expats and how to report it correctly to HMRC. Get expert UK expat tax advice.

2026 Statutory Residence Test Guide

Master the UK Statutory Residence Test (SRT) for 2026. Learn how the automatic tests, sufficient ties, and the new FIG regime affect your expat tax status.

YOUR UK TAX EXPERTS WORLDWIDE