UK Tax Return For Expats & Non-Residents

Living abroad? Our expat tax specialists prepare and submit tax returns for clients worldwide, ensuring full compliance with HMRC and meeting the self-assessment tax return deadline.

Help submitting UK non resident tax return

We make the process simple, fast, and secure — so you can stay focused on your life abroad while we handle your UK self-assessment tax forms.

Free Consultation

Document Gathering

Return Preparation & Filing

Self-assessment tax return deadline

One of the most important aspects of filing a UK tax return is meeting the self-assessment tax return deadline. Missing this deadline can lead to automatic penalties and interest charges.

Key Tax Return Dates for Individuals

Do expats need to file a UK tax return?

Many expats assume that once they leave the UK permanently, they no longer have to worry about taxes. In reality, your tax obligations depend on your SRT residency status and the types of incomes and gains you receive.

You may still need to complete a UK tax return if you:

Professionals who move between countries but retain UK employment or sole trade.

UK nationals living or working abroad who still have UK incomes or assets.

Professionals who move between countries but retain UK employment or sole trade.

Individuals living overseas with rental income from UK property.

Brits returning home who need advice on residency status and global income.

Foreigners who are UK tax residents and earning foreign-source income.

Even if you are classed as a non-resident for tax purposes, HMRC often requires you to report UK-sourced income through the Self Assessment system. This means that expats may still need to submit a UK tax return annually to ensure their income is properly declared. For more details about residency rules, see our guide to the SRT.

Why expats use professional UK tax advisors

Filing a UK tax return as an expat can be more complicated than completing a standard domestic tax return. Expats often deal with multiple tax systems, different currencies, and complex residency rules. By working with experienced advisors can reduce stress and ensure your return is accurate and submitted correctly.

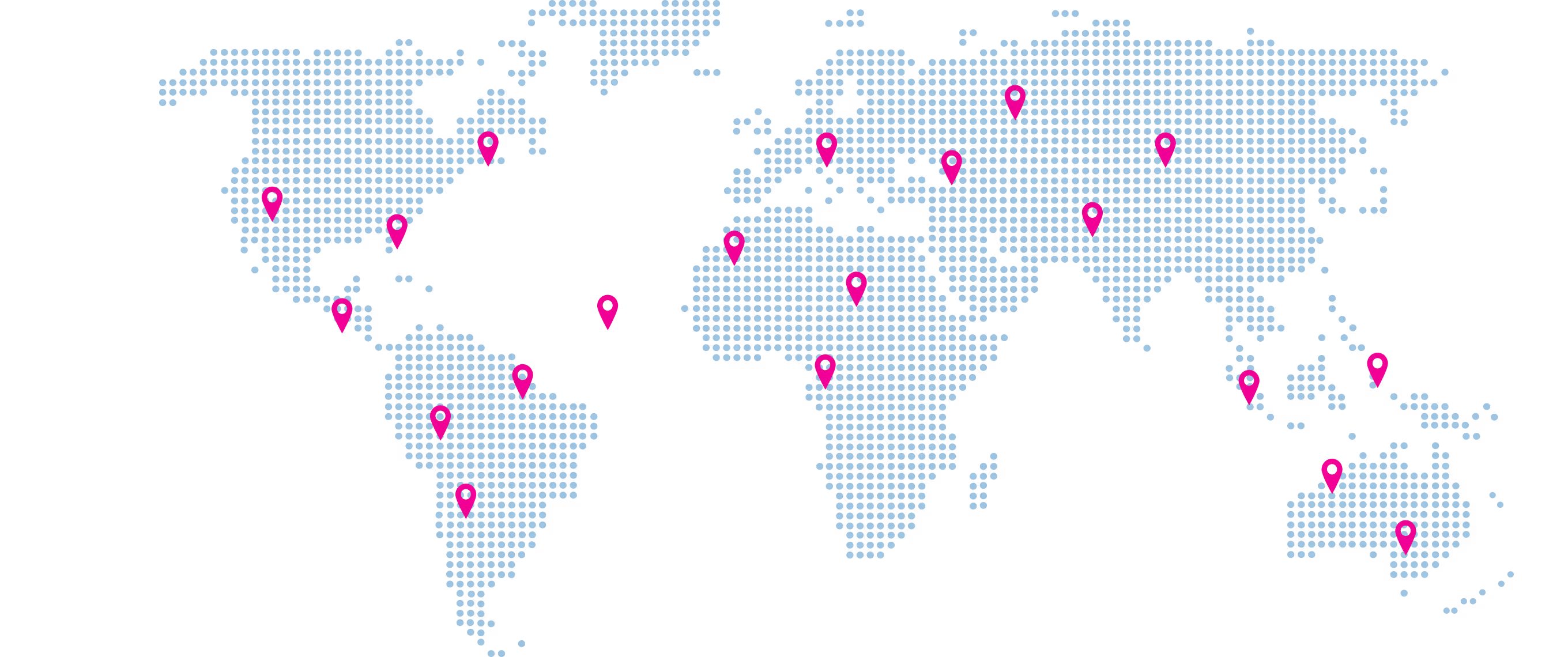

We specialise in cross-border UK tax advice, serving expats, nomads, and mobile professionals in 50+ countries.

200+ 5* reviews across Google and Trust Pilot. GTC is trusted by individuals worldwide to deliver reliable UK tax return services.

We fix fees before commencing work — you’ll always know what you’re paying for and payment is due upon delivery of services.

Our online portal makes managing your UK tax return easy— securely upload documents, sign forms and message your tax advisor.

Personal Tax Data for 150+ Countries

GTC have launched TaxPilot - a database that gives you instant access to up-to-date personal tax information for over 150 countries. Whether you're relocating, working remotely, or managing multi-jurisdictional income, our tax index helps you compare and understand:

🌍 Start exploring TaxPilot now or speak to an advisor for country-specific guidance.

Trusted by clients in 50+ countries

Common UK tax return questions from expats

Get help with your UK tax return

Contact us today to ensure your British tax return is completed accurately and submitted before the self-assessment tax return deadline.