UK Tax Guidance For

Non Doms & New Arrivals

Whether you're starting a new life in the UK, or returning home after years abroad, our expert team guides you through the UK’s complex tax landscape to ensure you’re compliant and positioned for success.

MOVING TO THE UK

As UK expat tax specialists, we are uniquely positioned to advise globally mobile individuals with complex international tax profiles, and we pride ourselves on delivering practical solutions that offer peace of mind.

MOVING TO THE UK MILESTONES

Use this timeline to plan your arrival to the UK tax system and stay fully compliant with HMRC.

You may benefit from realizing income, gains, or bonuses before UK residency starts to avoid UK tax — proper timing can save thousands.

If you decide to pay tax on global income and the source country also taxes the income, double tax treaties will detail the steps you need to follow to mitigate double taxation. Separately, you may be able to apply double tax treaty provisions to exempt the UK from taxing income.

Understand when you’ll become UK tax resident under the Statutory Residence Test (SRT) — this could be earlier than your physical move date depending on work, ties, and visits. If you’re arriving mid-tax year, you may qualify for split-year treatment, meaning only income from your UK-resident period is taxable — a key relief to plan for.

If you're a new arriver, consider using the FIG scheme, which allows you to avoid UK tax on foreign income and gains for up to four years. To be eligible, you must demonstrate ten consecutive years of non-residence under SRT prior to the tax year of relocation.

If you have previously filed your tax affairs under the remittance basis and wish to remit the foreign incomes and.or gains to the UK, you can use the TRF to remit the funds for a flat tax rate of 12% in the 2025/26 and 2026/27 tax years or 15% in the 2027/28 tax year.

The SRT looks at the number of days you spend in the UK, as well as ties such as family, property, and work. Providing that you achieve a non-resident status, HMRCs right to tax your income will be limited to UK sourced income only and thus, it is critical that you understand the steps you need to take to achieve a non-resident status if you wish to mininise UK tax exposure whilst overseas.

If you continue to receive income from the UK (rental, pensions, dividends), you may still have UK tax obligations. Each type of income is treated differently for non-residents, so it’s essential to get tailored advice.

The UK has tax treaties with many countries to prevent you from being taxed twice on the same income. Applying these treaties can reduce your overall tax burden and avoid complications in your new country.

The temporary non-resident rules can bring incomes and gains that are tax free in real time due to your non-resident status, back within the scope of UK taxation broadly if you return to the UK within five years. It is critical you take steps to avoid being caught by these rules upon repatriation to the UK.

To notify HMRC of your departure, you can complete Form P85 or SA109 pages on your self assessment tax return. This will trigger refunds or NT (No Tax) coding for employees.

UK CROSS BORDER SPECIALISTS

We are a team of experienced and qualified tax advisors committed to helping individuals navigate the complexities of the UK tax system.

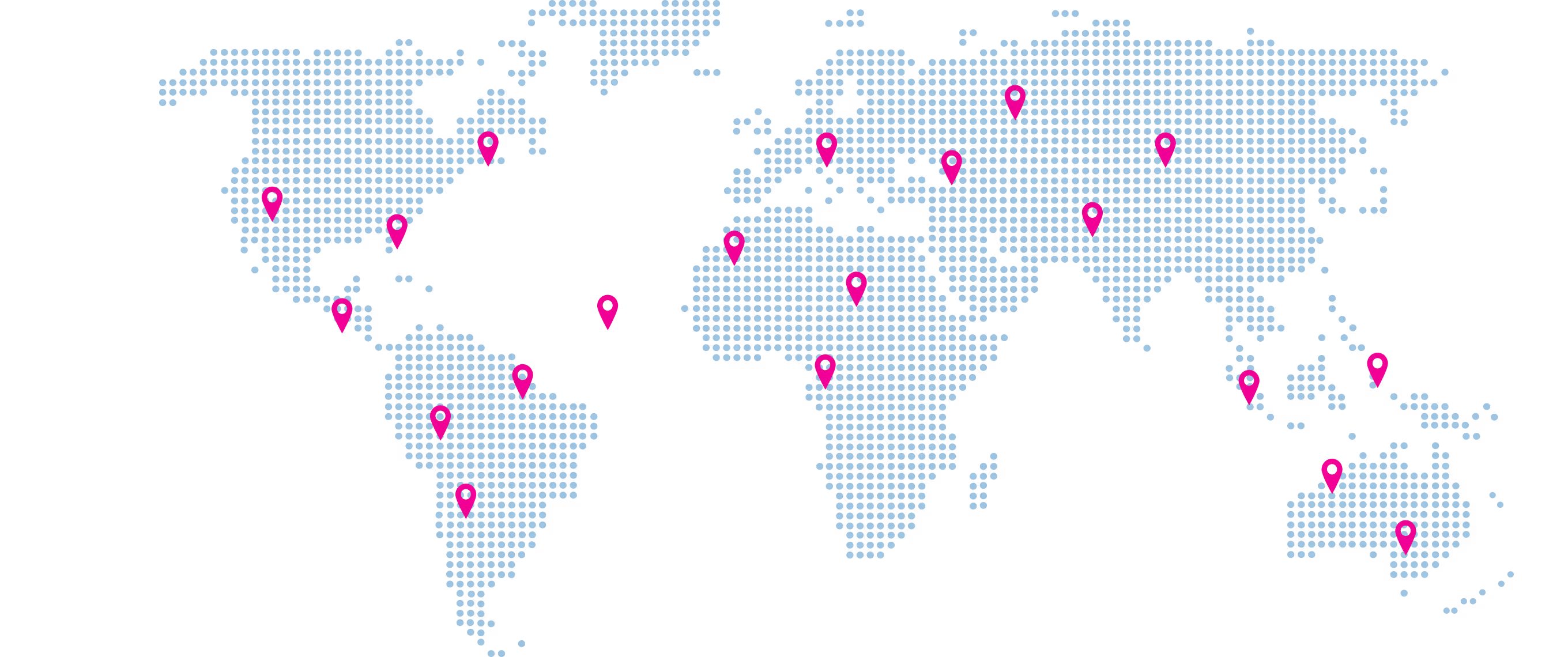

We specialise in cross-border UK tax advice, serving expats, nomads, and mobile professionals in 50+ countries.

100+ 5* reviews across Google and Trust Pilot. GTC is trusted by individuals worldwide to deliver reliable UK tax support.

We fix fees before commencing work — you’ll always know what you’re paying for and payment is due upon delivery of services.

Our online portal makes managing your UK tax affairs easy— securely upload documents, sign forms and message your tax advisor.

TIPS FOR MOVING TO THE UK

Personal Tax Data for 150+ Countries

GTC's Global Tax Index gives you instant access to up-to-date personal tax information for over 150 countries. Whether you're relocating, working remotely, or managing multi-jurisdictional income, our tax index helps you compare and understand:

🌍 Start exploring our tax data now or speak to an advisor for country-specific guidance.

MOVING TO THE UK TAX ADVICE

START OPTIMIZING TODAY

.avif)