Spain Tax Guide

Currency

EUR

Capital city

Madrid

Time zone

CET (UTC +1)

Introduction

Spain, renowned for its vibrant culture, Mediterranean climate, and picturesque landscapes, also offers enticing tax policies, especially for expatriates and new residents, make it a highly attractive destination.

If you’re planning a move to Spain or if you’re already living in Spain, it’s important that you review your tax position. As an expat, you may be able to take advantage of tax regimes, investment strategies and business planning that can work favourably for you and your new life in Spain.

Generally, it is best practice to organise your affairs in good time to get ahead and make the most of favourable tax treatment while making sure you’re meeting your tax declaration obligations.

How you’re taxed in Spain

Spain follows a residence taxation model. If you are resident, Spain will levy personal taxation on worldwide incomes. If you are non-resident, Spain will levy personal taxation on incomes arising in Spain only.

Resident

Local income

Foreign income

Non-resident

Local income

Foreign income

Your resident status in Spain

You will be considered tax resident in Spain, if you satisfy either of the following criteria:![]() 1. You are present in Spain on more than 183 days during the tax year.

1. You are present in Spain on more than 183 days during the tax year.![]() 2. Your centre of vital interests (personal, economic and social ties) are located in Spain during the tax year.

2. Your centre of vital interests (personal, economic and social ties) are located in Spain during the tax year.![]() 3. You are a Spanish national who relocated to a tax haven less than 5 years ago.

3. You are a Spanish national who relocated to a tax haven less than 5 years ago.

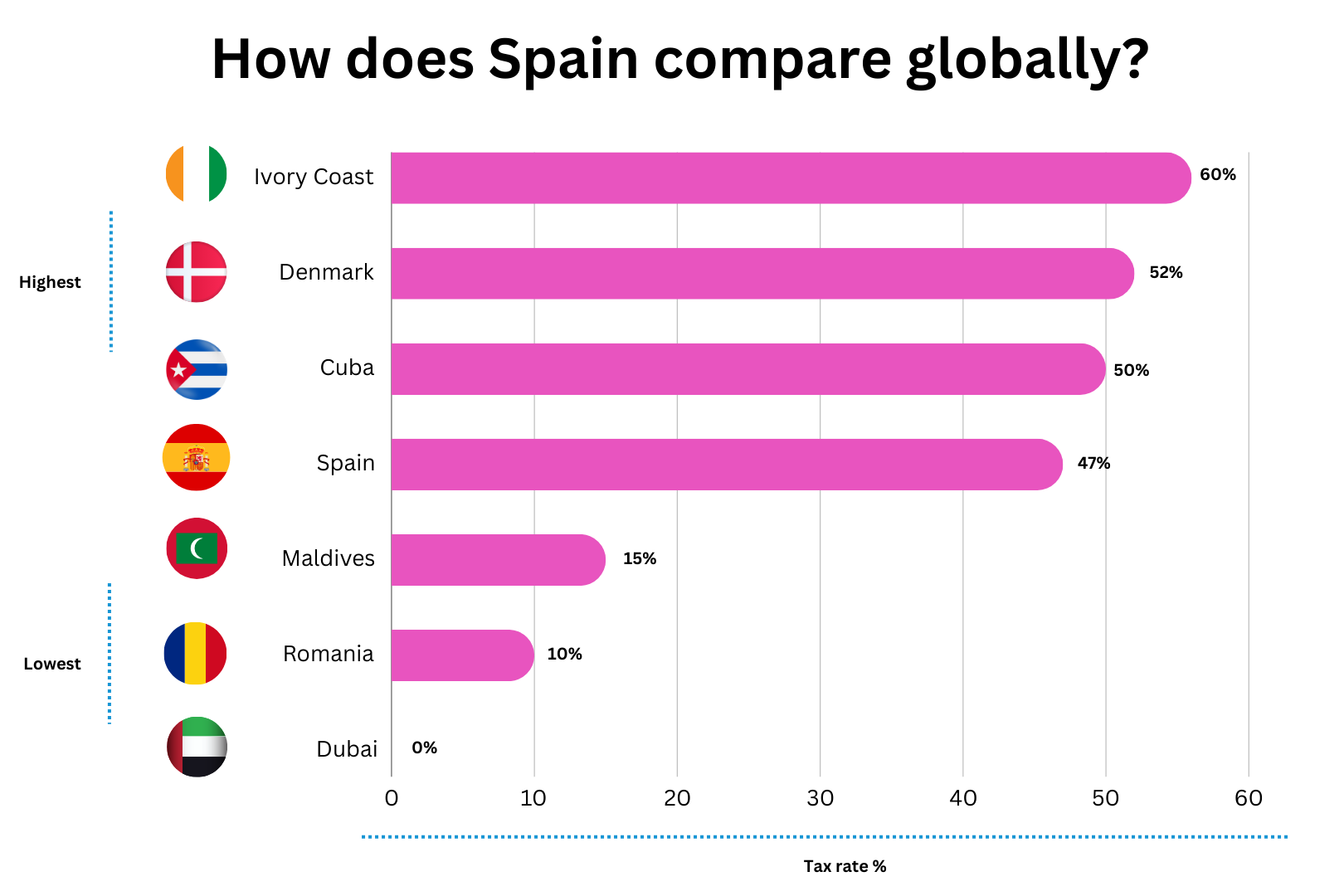

Personal income tax rates in Spain

Residents are subject to progressive tax rates as follows:

| Taxable amount (up to EUR) | Tax rate (%) |

| 0 – 12,450 | 19% |

| 12,450 – 20,200 | 24% |

| 20,200 – 35,200 | 30% |

| 35,200 – 60,000 | 37% |

| 60,000 – 300,000 | 45% |

| 300,000 + | 47% |

*Note that residents are entitled to a 5,550 EUR personal allowance which is deducted before income is subject to the above tax rates.

Special tax regime in Spain

Providing that you are considered an ‘expatriate’, you may be eligible to use Spain’s special tax regime ‘Beckhams Law’ which enables you to be taxed as a non-resident, even though you are living & working in Spain.

To be eligible for this scheme you must demonstrate 10 years of non-residence and you must apply to use the scheme within 6 months of moving to Spain.

Benefits of the regime are as follows:![]() 1. Flat tax rate of 24% levied on employment or self-employment income up to 600,000 EUR.

1. Flat tax rate of 24% levied on employment or self-employment income up to 600,000 EUR. 2. Foreign income exempt from Spanish taxation.

2. Foreign income exempt from Spanish taxation. 3. Special tax status applies for 6 years.

3. Special tax status applies for 6 years.

Spain can be a very tax efficient place to live and as such, Global Tax Consulting recommends seeking personalised tax planning advice to take advantage of the special tax regime.

Other personal taxes in Spain

Residents may be subject to the following personal taxes:

Asset tax

Tax on property and share sales

Death tax

Tax on assets passed to heirs

Wealth tax

Tax on value of owned assets

Social tax

Tax to contribute to state welfare

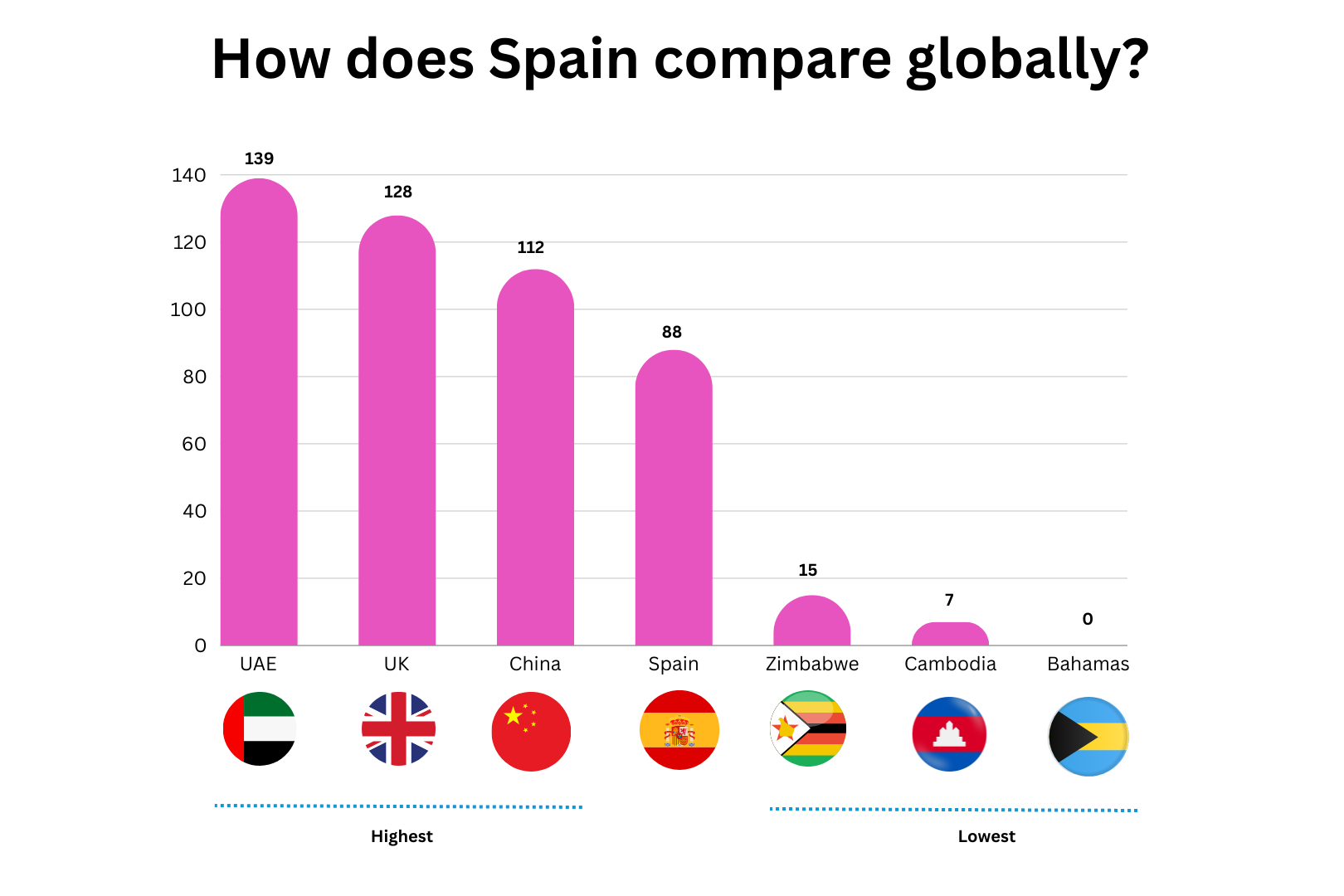

Double Taxation Agreements in Spain

Double taxation agreements can be used to 1) mitigate double taxation and 2) receive tax free income.

As such, the more double taxation agreements a country has, the better, as agreements will ensure you’re not taxed twice and even better, ensure your income is tax free.

At present, Spain has 88 double taxation agreements signed which you can view here.

This is high in comparison to the rest of the world, as follows:

Tax obligations in Spain

What is the tax year period?![]() The tax year starts on 1 January and ends on 31 December.

The tax year starts on 1 January and ends on 31 December.

What is the deadline to file tax returns and settle tax liabilities?![]() The deadline to file your tax return (Modelo 100) and settle your tax liability is 30 June following the end of the tax year.

The deadline to file your tax return (Modelo 100) and settle your tax liability is 30 June following the end of the tax year.

Do you need to make advance payments of tax?![]() No you will not be required to make advance payments of tax.

No you will not be required to make advance payments of tax.